On June 14 2023, the Central Bank of Nigeria released operational changes to the foreign exchange market. This article provides an easy-to-understand explanation of the new policy....

Hi. I’m Wilson Erumebor, an Economist with over a decade of experience in macroeconomic and industry research, data analysis and policy advocacy.

My Passion and Focus is to provide economic insights to aid decision making

Whether it’s for businesses, NGOs and government, I provide quality research outputs to ensure informed decision making.

For over a decade, I have built expertise in areas such as macroeconomic research, industry analysis, structural transformation and social & economic inclusion.

I provide macroeconomic reports, policy insights and research services for corporates and large organisations. I deliver keynote presentations on economic issues and feature on panel sessions and media interviews discussing the economy of Nigeria and Africa.

Some organisations I have engaged with include: Fate Foundation, Imara Africa, Phillips Consulting, Nextnomics Advisory, World Bank, DFID PDF II, Premium Pensions, Verakki Partners, Basic Education Africa, Next Generation Summit, Union Bank, PAC Holdings, Siemens Nigeria and the Nigerian Economic Summit Group.

I am a member of the Royal Economic Society, London, UK and a senior research fellow at The FATE Institute, Lagos, Nigeria.

In this article, Wilson Erumebor discusses economic diversification in Nigeria within the context of a dynamic local and global landscape....

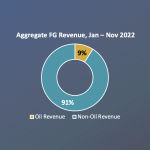

16 February 2023In 2020, Nigeria recorded its largest trade deficit of N7.38 trillion. The dollar value of exports significantly declined from US$122 billion in 2011 to US$32.8 billion in 2020. This brief examines Nigeria’s trade in goods performance in 2020 using recent data from the NBS....

11 March 2021As the Nigerian economy goes through tough times due to the fall in oil price and the impact of Covid-19, citizens and businesses will feel the brunt; thus, individuals, businesses and families would need to adopt survival strategies and mechanisms to get through the difficult times ahead....

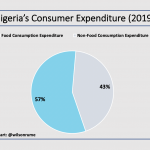

16 May 2020In May 2020, the National Bureau Statistics (NBS) released 2019 Consumption Expenditure Pattern in Nigeria. According to the NBS, the purpose of this report is to portray household consumption expenditure types by food and nonfood items at the national, zonal level, and state level, and also the urban/rural split. Total......

10 May 2020On Friday, February 28, 2020, Nigeria reported the first confirmed case of the Corona virus. Prior to this, Nigeria has been feeling the impact of the virus through declining crude oil prices in the international market. Oil price (Bonny light) declined from US$70 per barrel (pb) in January 2020 to US$50pb on February 28th, below the 2020 budget benchmark of US$57pb. With oil price as......

5 March 2020By the year 2050, Nigeria’s population will more than double its current size to reach 402 million, making Nigeria the third most populous country in the world. Also, in 2050, 67% will be below 35 years and about 62% will fall in the working age group. This growing population will......

5 December 2019

Need macroeconomic, industry or policy reports and presentations? Or you need an in-depth and informed analysis about the Nigerian economy to aid decision making?

Let’s discuss your needs in detail.

Wilson on Aljazeera: Nigeria’s cash crunch will slow down economic growth in 2023Q1

Wilson shared thoughts on Nigeria’s recession exit on AriseTV